Key Takeaways:

- Convenience and Shared Responsibility: Joint credit cards can simplify shared expenses and even help improve both parties' credit scores. However, they also mean both people are equally responsible for any debt, which can create financial and relationship stress if not handled carefully.

- Open Communication Before Applying: Have an honest discussion about financial habits, goals, and expectations. Understanding each other’s approach to spending and debt is crucial to avoid future conflicts.

- What to Expect When Applying For A Joint Credit Card: Both applicants will be subject to a credit check. Choose a card that fits your shared needs and set clear guidelines for how you’ll use and pay off the card together.

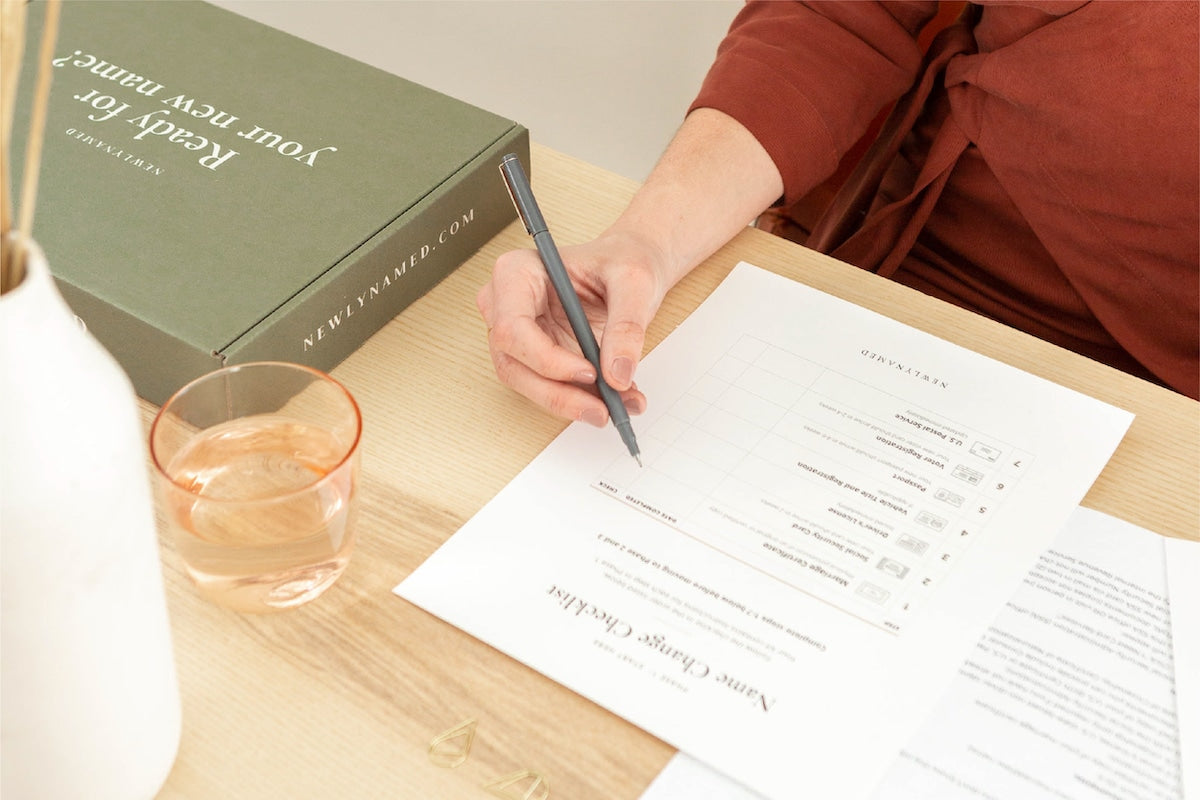

Changing your name marks the beginning of a new chapter, whether you’re tying the knot, starting over, or simply adopting the name you’ve always wanted. But as anyone who’s ever updated their ID, bank accounts, and credit cards will tell you, organizing your financial life after a name change comes with its own set of challenges (not to mention a whole lot of paperwork).

Maybe you and your spouse are looking for ways to manage money together, build credit as a team, or simplify your accounts now that you share a last name. Or maybe you're finding your footing after a divorce and want to untangle your finances. In either scenario, figuring out how to get a joint credit card is often a part of embracing your new identity.

In this guide, we’ll break down how joint credit cards work, the pros and cons you’ll want to consider, and all the small but important steps in between, including how to update your name on your new account. Whether you’re in the midst of a major life transition or just planning ahead, we’ll help you tackle joint credit with a confident, organized approach — because that’s what we’re all about at NewlyNamed. Let’s dive in!

How Do Joint Credit Cards Work?

Joint credit cards allow two people (often spouses or partners) to share one credit card account, each with their own card and equal access to the credit line.

Joint Ownership vs. Authorized User

This setup is different from simply adding someone as an “authorized user.” With a joint credit card, both people are listed as co-owners of the account. That means both applicants’ credit scores, incomes, and existing debts are reviewed when applying. Approval decisions and credit limits are based on this combined financial snapshot.

Shared Access And Responsibilities

Both cardholders can make purchases, track spending, access statements, earn rewards, and redeem points. Since ownership is shared, responsibility is too — both people are legally liable for paying off the entire balance, not just their individual charges. If a payment is missed, both credit scores can be impacted, and both are on the hook for any debt on the account.

A Note On Availability

While joint credit cards sound convenient, they aren’t as widely offered today as they once were. Many credit card issuers now prefer to approve accounts for individual applicants, focusing on each person’s credit history (though they may still consider joint income).

As a result, many couples choose a different strategy: Each partner applies for their own card as a primary user and then adds the other as an authorized user. This approach allows each person to maintain their individual credit history while still sharing access and maximizing rewards, sometimes called the “two-player strategy.” It works best when both partners have strong credit and can commit to using the right cards for different types of purchases.

A notable exception is the Apple Card, which offers a true co-owner feature that allows equal sharing of responsibility and spending visibility.

Researching Joint Credit Cards

If you’re considering a joint credit card or exploring the authorized user approach, start by comparing options to find the best joint credit card (or card combo) that fits your shared goals. Look at reward programs, interest rates, fees, and added perks.

Before you take the leap, make sure you’re on the same page financially. For more tips on managing money as a team, check out our guides on how to combine finances after marriage and how to create a joint bank account. These steps can help lay a strong foundation before you open a joint credit card.

Pros Of Getting A Joint Credit Card

Sharing a joint credit card with your partner can make managing shared finances feel more seamless and transparent. While it’s not the right fit for every couple, many find the benefits significant. Here’s why:

- Streamlined Spending: With just one statement to track, it’s easier to see where your money is going. No more juggling multiple statements or sorting out who paid for groceries or date night. One card, one statement — simple and clear.

- Build Credit Together: When used responsibly, a joint credit card with a spouse can help both account holders strengthen their credit profiles. On-time payments and low balances positively impact both of your credit scores, which can be especially helpful if you’re planning a big financial move together, like buying a home.

- Shared Rewards: All your spending goes onto one account, meaning rewards points or cash back add up faster. Whether you’re saving for a future vacation or splurging on a cozy takeout night, combining your spending can help you reach those perks quicker.

- Transparency and Trust: A joint credit card makes spending visible to both partners. This openness can help foster trust, encourage conversations about money, and minimize financial surprises.

- Convenience During Emergencies: Forgot your wallet? Need to book last-minute travel? Either account holder can use the card, which means you’re both covered if plans go sideways.

- Easier Budgeting: Using a single card for shared expenses makes it simpler to set and stick to a household budget. At the end of the month, it’s easy to review spending together and adjust as needed, which can lead to less stressful money conversations.

Of course, a joint credit card isn’t right for everyone, but for couples or close partners looking to simplify and organize their finances, the perks can be significant.

Cons Of Getting A Joint Credit Card

While a joint credit card can be a great financial tool for some, it’s important to weigh the potential drawbacks carefully. If you’re wondering if you can (or should) have a joint credit card, here are a few of the most significant cons to keep in mind:

Shared Responsibility For Debt

When you open a joint credit card, both account holders are equally responsible for the entire balance, no matter who made the purchases. If one person runs up a large bill and can’t pay it back, both partners are on the hook. Missed payments or high balances can hurt both of your credit scores, even if only one person overspent.

Potential Strains On Relationships

Money matters can bring up strong emotions, and a joint account may highlight different spending habits, budgeting styles, or long-term financial goals. If one person is more of a saver and the other loves to spend, disagreements over card use can create tension and lead to tough conversations.

Complicated Separation

If the relationship ends (through divorce, separation, or even the decision to stop sharing financial accounts), closing a joint credit card or splitting the remaining debt can be messy. Both account holders must agree to close the card, and any outstanding balance needs to be paid off first. This extra step can add stress during an already challenging time.

Credit Score Impact

Since both people’s credit reports reflect all account activity, a missed payment, high utilization rate, or default can drag down both credit scores. Even if you handle your share responsibly, your partner’s financial habits can still affect your credit history.

Limited Rewards And Less Autonomy

Some folks love to optimize multiple credit card rewards, get different cards for specific perks, or maintain a sense of autonomy with their finances. A joint card means compromise — you have to agree on one card, one set of benefits, and one strategy. For some couples, this arrangement can feel restrictive.

By understanding these potential pitfalls ahead of time, you’ll be better equipped to decide if a joint credit card is the right fit for your financial life together.

Steps To Apply For A Joint Credit Card

Applying for a joint credit card is a smart way to share financial resources, build credit together, and manage household expenses with someone you love and trust. If you’re wondering how to apply for a joint credit card, here’s a clear step-by-step breakdown:

- Start The Conversation: Open up an honest discussion with your partner or the person you’ll share the card with. Talk through your spending habits, financial goals, and how you’ll both use the card. Transparency is key — you’ll want to be on the same page about payments, budgets, and responsibilities.

- Check Your Credit Scores: Both applicants’ credit reports will be pulled when you apply, so check your scores ahead of time. Many credit card issuers use the lower of the two scores, so it’s a good idea to review and resolve any discrepancies before applying.

- Research The Right Card: Not all credit cards allow joint applications (many offer only authorized user options), so look for issuers that specifically offer true joint credit cards. Compare options based on interest rates, rewards, fees, and benefits that match your shared lifestyle.

- Gather Required Information: You’ll both need to provide personal details like your legal names, addresses, employment info, income, and possibly housing costs. Double-check issuer requirements so you have everything ready.

- Complete the Application Together: Apply online or in person, making sure to fill out both applicants’ information accurately. The issuer will process both credit reports, so you’ll need to consent to credit checks.

- Wait for Approval: After submitting, the bank reviews your application and credit history. If approved, you’ll both receive access to the same credit line. Cards typically arrive within a week or two, and then you’re officially ready to start using your account together!

- Set Ground Rules For Usage And Payments: Agree on how the card will be used and set reminders or autopay to avoid missed payments. Remember, any missed payments or overspending impacts both credit scores, so make a plan you both feel good about.

Applying for a joint credit card is a big and exciting step in your financial journey. Approaching it with care, mutual respect, and a shared understanding of the responsibilities is a surefire way to set yourself up for success. And if you recently got married or divorced, make sure your name is updated and accurate on all your paperwork first. NewlyNamed’s name change packages can help you handle that easily before you apply.

Final Thoughts

While joint credit cards come with plenty of pros — like shared rewards and easier budgeting — they also come with important considerations, like shared responsibility and potential credit risks. Whether you choose to open a joint credit card or explore other options, it’s essential to stay organized and communicate openly.

If a name change is part of this new chapter, that’s where NewlyNamed comes in. Our mission is to make your name change as easy and stress-free as possible so you can focus on bigger things, like building a life together or turning the page after a divorce. Our Print at Home Name Change Kit and the NewlyNamed Box cover the entire name change process, from your Social Security card and driver’s license to all your personal accounts — including those new or updated joint credit cards. Each kit comes carefully designed with step-by-step instructions, so you never feel lost along the way.

Whether you’re applying for a joint card with your spouse or updating your financial records after a court-ordered name change, NewlyNamed can help you feel fully supported. Let us handle the paperwork so you can enjoy what’s next.

Read also:

- What Is Joint Credit And How Does It Work?

- Financial Advice For Married Couples: Smart Money Moves For A Stronger Relationship

- How To File Taxes Jointly For The First Time: What You Need To Know

Frequently Asked Questions About How To Get A Joint Credit Card

How long does it take to get approved for a joint credit card?

Approval times vary, but you can usually expect a decision within a few minutes to a couple of weeks. If the issuer needs additional information or documents, it could take longer. Most banks process applications online, which can speed things up considerably.

Can a joint credit card help build credit history?

Yes! Both joint account holders share responsibility for the card, and any payment activity — good or bad — shows up on both credit reports. Making on-time payments helps build credit for both, while late payments or high balances negatively impact both credit scores.

Are there different types of joint credit cards available?

Joint credit cards typically work like standard credit cards, but not all issuers offer them. Some may suggest adding an authorized user instead. If you’re shopping for a joint card, compare features like rewards, interest rates, and fees, just as you would with any credit card. The terms will differ by bank, but the main idea is shared ownership and responsibility.

How is interest charged on a joint credit card?

Interest is charged on joint credit cards just like on individual ones. It’s based on the outstanding balance, and both cardholders are equally responsible for any charges and accrued interest. That means if there’s a balance carried over from month to month, both parties are on the hook for the interest, no matter who made the purchases.

Can a joint credit card have more than two cardholders?

Most joint credit card accounts are limited to two primary account holders. However, many banks allow you to add authorized users: people who can make purchases but aren’t responsible for paying the bill. Only the two joint primary holders are equally liable for the full account balance.

Can you remove someone from a joint credit card?

Removing someone from a joint credit card isn’t as simple as calling your bank. Most credit card issuers require the account to be paid off and closed in order to remove a joint holder. You’ll typically need to apply for a new solo account if you want to keep using that card’s perks without the other person.